Working a traditional 9 to 6 job and envisioning to witness grounding breaking success?

Well, that’s not what converts!

Plenty of bread-winners out there lives in cubicle nation ever since they stepped into the corporate world.

Keeping a single revenue stream is never sufficient enough to finance your goals and ambitions.

We often hear peeps rave about making money while enjoying a mint margarita along the shore.

Yes, that doesn’t happen unless you belong to the small team of ‘the most high-profile heads of the state.’

Sad to state that most of us don’t belong in there.

Then how to make bucks without requiring to do a lot while identifying both our personal and professional goals?

Thanks to the proliferating numbers of secure passive income sources that have decluttered day to day business activities and have offered wage earners with reliable side-hustles and makes them a decent dough of money with minimum hassle and maximum return.

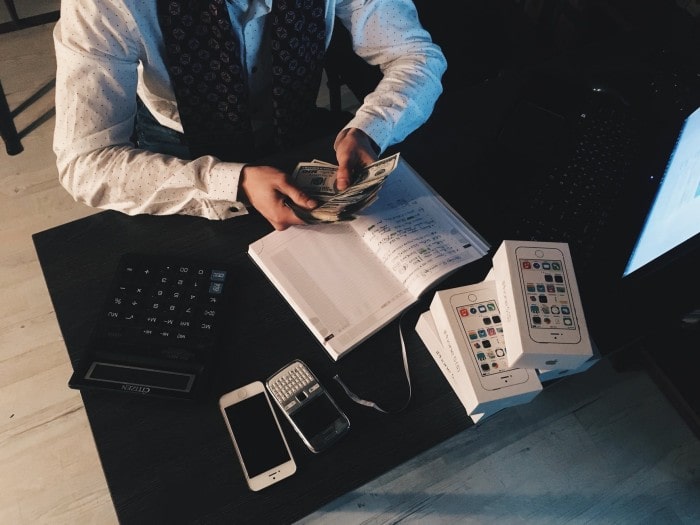

So let’s figure out what additional streams your financial circumstances require the most to transform you from a corporate prisoner to a hustling financier.

It’s time to roll up on these proven side gigs that are certain to lick your financial status into shape.But before you try to buckle down to master these side-hustles, let’s learn what is passive income.

A General Outline of Passive Income

Passive income is polls apart from the conventional occupational approach. It doesn’t require continual engagement or active participation. Once you dive into one, it keeps pouring in revenue.

Nifty, isn’t it?

Passive income, aka side hustles, minimizes the chances of getting you into a hot situation. So you don’t be concerned about your current day job because whether it’s downsizing or laying off employees from massive brands, any corporate crisis won’t have an impact your financial health much as long as you are backed by a secure side-hustle.

Besides achieving financial liberty, a secure source of passive income hastens your way towards reaching your goals faster, unlike a traditional job that leaves you burned out. Moreover, a reliable passive income contributes to a stable retirement.

Opting for a secure source of revenue stream aligned with your expertise and requirements can certainly diversify your actual return on investment.

Starting the passive income sources from high-risk investments, which are more likely to dispense a higher return on investment. Though these sources have a lot of uncertainty factor involved but yields substantially higher rewards than estimated.

-

Peer To Peer Lending (P2P)

This business strategy works by finding a reliable peer to peer lending platform, which connects moneylenders and borrowers.

One could invest in various kinds of loans having varying sets of repayment facilities. This way, the investor could earn the income when the borrower repays the owed amount with interest.

But in case you find it full of risk, it’s better to play safe and start investing from small amounts ranging from $ 25 to $50.

However, if you are inclined more towards investing your time/ efforts/skills rather than money, you could also leverage your stern efforts and get them monetized via low-risk investment platforms.

-

Dividend Stocks

This way is excellent and a surefire passive income hack to get your bank account flooded with dollars. Initiate by shortlisting companies with a history of considerable dividend growth. Then dive into the calculation of the dividend/profit yield.Now divide the payable amount of dividend earned per annum by the stock price.If a stock pays dividends of $1.00 per share once a year and sells at $10, the profit earned would be 10%.

By doing so, you will be scheduling your dividend pays to smartly cope with occurring irregularities of income.

Pro Tip of the Day

When dealing with dividends, it is best to keep them for long intervals to yield the maximum profit possible also never respond to market abnormalities.

Coming to some passive income sources, which involves low-risk investments and requires more time than money. Here’s how you can arouse a pre-existing revenue stream.

-

Affiliate Marketing

From Tikor’s Nano influencers to mega bloggers to eminent YouTuber’s everyone is into affiliate marketing. If you’ve a solid following on social media platforms, you can feasibly make a mint form it. Promote a product and earn a commission. Though it is just an underlying concept, affiliate marketing is massive and involves a lot and definitely requires time to turn up a profit.In case you don’t have an existing profile to flaunt as an affiliate marketer, you can learn the skill by checking out a few proven affiliate marketing tips to get started soon.

-

Vending Machines

Vending machine franchises heads the list of micro businesses. Set up one in a space where people tend to require small goods at economical rates. Though this will require inventory restocking from time to time, so the machine never runs out of the supplies entirely; still, this has to be a proven way of escalating passive income growing your corporate circle.

-

Leverage Your Photography Skills – Stock Photos

If you enjoy camerawork and possess some hardcore photography skills, you can downplay your efforts and get some easy money through it.

Sell the copyrights of the photos you wish to monetize, either to content creators in search of compelling photographs or to brands.

But if this doesn’t sound captivating enough, you can deploy your times to capture mesmerizing shorts to exhibit in a local art show to earn both clients and cash.

Here are some platforms that welcome fine quality pictures and pay.

- Shutterstock

- iStock

- Fotolia

A thing to keep in mind is that all of the above-stated platforms offer varying commission rates per download.

Passive Calls for a Little Action

Although passive income is unparalleled in staving off the chances of a financial crash and to make surplus income to be able to finance your dreams without any aid from your parents. It also requires a bit of stern working at its infancy as none of them are purely passive right off the bat.

Investing your sweat equity to yield potential income is a big decision. So once you are certain to do so, be sure to devote some hours and a little money to build passive income streams that can benefit you later.